billings montana sales tax rate

- Tax Rates can have a big impact when Comparing Cost of Living. Moreover the court order demonstrated that city.

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

Fastest Quick-turn in the RegionMid-Rivers Webmail is brought to you by Mid-Rivers Communications 904 C Ave Circle MT 59215 Tel.

. Rob Stephens is the founder of Avalara MyLodgeTax and a vacation rental owner. There is no local add-on tax. The Billings Sales Tax is collected by the merchant on all qualifying sales made within Billings.

4 rows The current total local sales tax rate in Billings MT is 0000. The sales tax rate does not vary based on location. The sales tax rate does not vary based on zip code.

The Montana MT state sales tax rate is currently 0. The average cumulative sales tax rate in Billings Montana is 0. The County sales tax rate is.

Cost of living in montana. Sales tax region name. 140000 Gallon Jet A 32000 Gallon Avgas Storage Capacity.

All EJC Linemen are NATA Safety 1st Trained. The US average is 28555 a year. The minimum combined 2022 sales tax rate for Billings Montana is.

2022 Cost of Living Calculator for Taxes. The most populous location in Montana is Billings. Georgia sales tax rate 2021.

The state sales tax rate in Montana is 0. This is part of the complexity. The US average is 46.

Under state law the government of Billings public schools and thousands of other special districts are given authority to appraise real property market value set tax rates and collect the tax. This is the total of state county and city sales tax rates. Billings is located within Yellowstone County Montana.

Tax rates last updated in July 2022. Montana is one of only five states without a general sales tax. - The Income Tax Rate for Billings is 69.

Income and Salaries for Billings - The average income of a Billings resident is 28364 a year. Billings MT Sales Tax Rate. Bozeman MT Sales Tax Rate.

The December 2020 total. Tax Rates for Billings - The Sales Tax Rate for Billings is 00. The most populous county in Montana is Yellowstone County.

The average cumulative sales tax rate in the state of Montana is 0. Bozeman Montana and Billings Montana. The Billings Montana sales tax is NA the same as the Montana state sales tax.

The Billings sales tax rate is. The Montana MT state sales tax rate is currently 0. This takes into account the rates on the state level county level city level and special level.

Avalara provides supported pre-built integration. This includes the rates on the state county city and special levels. In Montana theres a combined 7 lodging sales and use tax which must be paid quarterly.

The US average is 73. Required to collect and remit the 3 sales tax is required to apply to the Department of Revenue for a sellers permit before they engage in business. The Montana sales tax rate is currently.

The asking price of single family homes can start from 42000 and can go up. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales. The sales tax rate does not vary based on county.

On Logan Field Since 1940. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. Montana has no state sales tax and allows local governments to collect a local option.

The newly listed homes for sale are 28. A protracted battle that affects nearly every resident living within Montanas largest city may wind up costing the City of Billings between 6 million and 8 million as a judge ruled franchise fees charged to water and sewer users were illegal sales taxes prohibited by state law. Biggest city in montana.

There are three main stages in taxing property ie setting mill rates appraising property market worth and taking in payments. Revenues collected from the 4 lodging facility use tax are deposited to a state special revenue fund. The combined sale tax rate is 0.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Montana is one of the five states that have no sales tax. Within Billings there are around 13 zip codes with the most populous zip code being 59102.

The Billings sales tax rate is NA. Montana cities andor municipalities dont have a city sales tax and there are no local taxes beyond the state rate.

Press Release Domo Announces Fourth Quarter And Fiscal 2020 Financial Results Domo

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Irs Issues Applicable Federal Rates Afr For September 2021

Morristown City Council Approves Adjusted Tax Rate Local News Citizentribune Com

Sales Tax On Cars And Vehicles In Wyoming

Supreme Court Ruling Means Sales Tax Changes For Montana S Online Businesses Montana Public Radio

Supreme Court Ruling Means Sales Tax Changes For Montana S Online Businesses Montana Public Radio

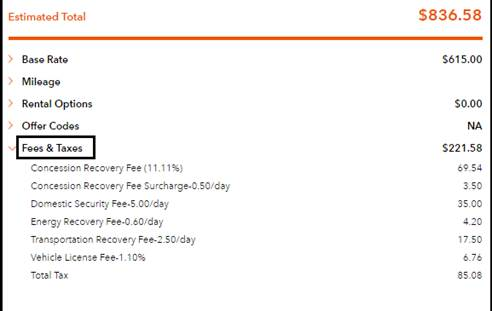

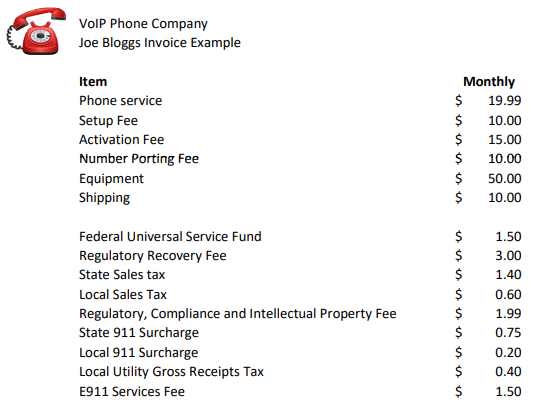

Voip Pricing Taxes And Regulatory Fees Explained

Press Release Domo Announces Fourth Quarter And Fiscal 2019 Financial Results Domo

5 Things Construction Contractors Should Know About Sales Tax